The bad news about getting hit by an uninsured driver? You just found out that the driver who hit you does not have liability insurance or they do not have enough coverage. The good news is that you still may be covered in Alabama.

Under Alabama’s Uninsured Motorist law, car insurance companies are required to provide uninsured/underinsured motorist insurance (known as UM / UIM coverage) on every automobile insurance policy sold in Alabama. The only way around this rule is for the insurance company to have the insured sign a written waiver rejecting this coverage.

This coverage can be a huge help if you have been injured in a car crash – and you discover that the driver who hit you has shirked their auto insurance obligations. You cannot count on other buyers to purchase enough coverage to protect you, so you may need to purchase UM/UIM coverage to protect yourself.

This coverage can be a huge help if you have been injured in a car crash – and you discover that the driver who hit you has shirked their auto insurance obligations. You cannot count on other buyers to purchase enough coverage to protect you, so you may need to purchase UM/UIM coverage to protect yourself.

How Uninsured Motorist Coverage Works

When a car accident in Huntsville is someone else’s fault, you normally seek compensation through the other driver’s liability coverage. But, if that coverage does not exist or is simply the minimum amount required ($25,000 per person and $50,000 per accident), then your UM / UIM coverage helps to fill the gap for medical bills and other damages.

When a car accident in Huntsville is someone else’s fault, you normally seek compensation through the other driver’s liability coverage. But, if that coverage does not exist or is simply the minimum amount required ($25,000 per person and $50,000 per accident), then your UM / UIM coverage helps to fill the gap for medical bills and other damages.

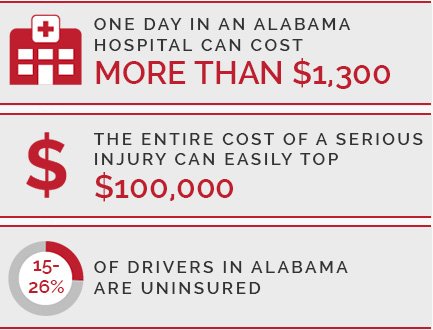

This can be crucial assistance. A single day in an Alabama hospital can cost more than $1,300 on average, according to the Kaiser Family Foundation. The entire cost of a serious injury, such as a traumatic brain injury or a spinal cord injury, can easily top $100,000. With your UM/UIM coverage, you may recover for damages that include: personal injuries, medical bills, pain and suffering, lost wages, and, for especially egregious conduct, punitive damages.

Meanwhile, the Insurance Research Council says 15 to 26 percent of drivers in Alabama are uninsured.

The problem is, that even though they have it, many people do not understand UM / UIM coverage. It not only covers you, the driver, but it may also provide benefits to members of your family.

What the Insurance Information Institute Recommends: Uninsured Motorist Insurance

Typically, the amount of UM / UIM coverage in a driver’s policy will be equal to the liability coverage. But you can buy more and, if you can afford it, you should consider buying more than the minimum. Overall, UM / UIM coverage is inexpensive. The Insurance Information Institute recommends that you have UM/UIM coverage of at least $100,000 per person/$300,000 each uninsured car accident in Huntsville. You may want to review your present automobile insurance policy and consider whether you have enough UM/UIM coverage. Your insurance agent can assist you with adding UM/UIM coverage.

Typically, the amount of UM / UIM coverage in a driver’s policy will be equal to the liability coverage. But you can buy more and, if you can afford it, you should consider buying more than the minimum. Overall, UM / UIM coverage is inexpensive. The Insurance Information Institute recommends that you have UM/UIM coverage of at least $100,000 per person/$300,000 each uninsured car accident in Huntsville. You may want to review your present automobile insurance policy and consider whether you have enough UM/UIM coverage. Your insurance agent can assist you with adding UM/UIM coverage.

In many cases, you may have more coverage than it appears, and additional sources of coverage can be discovered by an experienced attorney. If you have more than one vehicle with uninsured motorist insurance, Alabama allows a process known as “stacking” in which drivers can multiply their uninsured motorist coverage by up to three times based on the number of vehicles on a single insurance policy or stacking an unlimited number of different insurance policies. You receive this coverage without paying any more premiums.. In other words, if you have 3 cars with $100,000/$300,000 in UM/UIM coverage, even though you are only paying for $100,000 per person/$300,000 per uninsured car accident in uninsured motorist coverage, you may be entitled to $300,000/$900,000 if you are injured in a motor vehicle collision. You may want to check your policies to be sure that all of your vehicles have UM/UIM coverage so that you can “stack” UM/UIM coverage.

If you have UM / UIM insurance and got hit by an uninsured driver in which this coverage comes into play, you may still have a problem, unfortunately. Insurance companies often balk at paying full claims, even to their customers. In other cases, they will try to pay so quickly that an injured driver unwittingly accepts a check and closes the claim before all of their damages are known. Even with a UM/UIM claim, the insurance company may not offer you what is required to pay for all of your damages. In some cases, it may require an attorney experienced in negotiating with car insurance companies and in Alabama courts to ensure that all car insurance payouts that you are due are paid in whole and promptly.

Morris, King & Hodge, P.C., attorneys work with car accident victims every day to help them obtain the auto insurance settlements they deserve. If you have questions about how your UM / UIM coverage applies to an accident you have been involved in, or if you have a settlement offer or other auto insurance concerns, our Huntsville car accident attorney can review your policy and accident, and answer your questions.

Do I Need Uninsured Motorist Coverage?

As a driver, you want to make sure that you have the right insurance coverage in place in the event of an accident. If you are hit by an uninsured driver or a hit-and-run driver in Alabama, you could be left to foot the bill on your own if you don’t have adequate coverage.

It’s not uncommon for drivers to question whether they need uninsured and underinsured motorist (UM / UIM) coverage if they have health care insurance. If you have questions concerning uninsured motorist coverage or underinsured motorist coverage, the Huntsville car accident lawyers at Morris, King & Hodge, P.C., are here to help. Call our experienced personal injury attorneys today.

Am I Required to Have Uninsured Motorist Coverage?

When you have UM / UIM coverage, you and your auto passengers are covered if the at-fault party does not have insurance (uninsured motorist) or if they do not have enough insurance to pay for all your damages (underinsured motorist). Thus, UM / UIM coverage not only protects you from individuals without insurance, but also under Alabama law can protect you in cases where they do not have enough insurance. From a legal perspective, the insurance carrier “stands in the shoes” of the at-fault party, and you may recover from your auto insurance company for damages that would be collectible from the at-fault driver.

As a driver in Alabama, it is up to you how much insurance you wish to purchase beyond the required minimums. Purchasing uninsured motorist insurance could actually save you a lot of money if you are involved in a crash. Even though liability insurance is mandatory, a large percentage of Alabama drivers still do not have insurance coverage. Also, many at-fault drivers only carry the minimum required limits of liability insurance, which may not be enough to cover your damages. If you are hit by a driver with insufficient liability coverage, then your underinsured motorist coverage may help to cover your losses. Once the at-fault driver’s insurance has paid, then you can recover your underinsured motorist benefits. You could save yourself from paying thousands in medical expenses after a collision with an uninsured driver, hit-and-run driver, or a driver who doesn’t carry enough liability coverage. Uninsured motorist coverage is some of the most affordable automobile insurance available, and it makes sense to increase your uninsured motorist limits to as much as you can afford.

UM insurance also covers your damages in a hit-and-run collision. Your insurer will treat the claim as if the at-fault driver stayed on the scene but did not have insurance. It also will cover you if you are insured by an automobile as a pedestrian. Even if an uninsured or underinsured motorist crashes into you, your own insurance company will pay for your damages. UM / UIM insurance can give you peace of mind as you drive throughout Alabama.

Medical Insurance Versus Uninsured Motorist Coverage

Some people decide not to get UM coverage after their insurer told them it wasn’t necessary because they had health insurance. This is a bad idea

Even if you have a good health insurance policy, you should still get UM coverage because health insurance only pays for medical treatment. In the case of a serious car accident, you will typically be entitled to much more than just medical treatment. If the at-fault party does not have insurance, or not enough insurance, to compensate you, then UM coverage can pay for damages beyond medical bills, including lost wages, lost earning capacity, pain and suffering, mental anguish, and more.

Benefits of Having Uninsured Motorist Coverage

While you should always opt for this coverage in Alabama, it’s important to consider raising your limits above the minimum. While you may have the minimum levels of UM coverage that will give you some protection should an accident occur, those limits may not be enough in the event an accident causes serious injuries and extensive vehicle damage.

If you have been injured in a car accident, no matter what type of insurance coverage you have, you should speak with a car accident attorney. Even though a UM claim is with “your” insurance company, their goal is still to pay as little as possible. You need someone who has your best interests in mind. You may be able to claim coverage under multiple vehicles in what is called “stacking” even if you were not in a vehicle listed on the policy. Also, for an underinsured motorist claim, you must take the correct steps to preserve your coverage under Lambert v. State Farm or you may waive your right to UIM coverage. Let our experienced car accident attorneys handle your claim so that you can focus on getting well. The Huntsville personal injury lawyers at Morris, King & Hodge, P.C., will stand up for your rights.

Car Accident FAQs

You probably won’t have to go to court after a car accident in Alabama, as most cases settle out of court. However, you may have to go to court if your case is complex or if the insurance company denies liability or disputes your claim. Our attorneys are ready to do what is required to maximize your compensation.

If the other driver is uninsured or underinsured, you may be able to file a claim with your auto insurance policy’s uninsured motorist or underinsured motorist coverage (UM/UIM). Our attorneys can help you seek out all potential sources of insurance coverage and pursue the maximum benefits you deserve.

It is helpful to bring any documents or information that will help your lawyer better understand your case, such as:

- Photos and videos of the accident scene

- A copy of the police report

- Eyewitness contact information

- Your insurance information

- Your medical records

- Your medical bills

- Your driver’s license

In Alabama, insurers must provide an update every 45 days, update the claim status within 30 days or whatever the policy specifies, and pay a settlement within 30 days of reaching an agreement with your lawyer. Insurers cannot delay your claim in an effort to run out the statute of limitations. Most personal injury claims in Alabama are settled within a year, and many are settled in a few months or even less. Cases usually take much longer if a trial is needed.

You want a lawyer who has extensive experience with car accident cases and knows how to pursue them to a successful conclusion. Look for an attorney who has a track record of securing large settlements and jury awards for previous clients. It’s a good idea to pick a lawyer with a reputation for being ready and able to take cases to trial if that’s what it takes to seek maximum compensation for you.

Our Alabama car accident lawyers work on a contingency fee basis, which means it costs you nothing to hire a lawyer. We get paid only if and when we succeed in recovering compensation for you. If our law firm obtains a settlement from the insurance company or an award from a jury, our fee is a percentage of the compensation we recover for you. That means you never pay us directly from your pocket.

Car accident lawyers can investigate the circumstances of the crash, review the police report, interview anyone who witnessed the accident, analyze photos and other evidence, and examine your medical records to determine the extent of your injuries. Your lawyer can calculate how much your personal injury claim is worth and negotiate with the insurance company to seek as much compensation for you as possible. If the insurance company does not offer a fair and reasonable settlement, your lawyer can take the case to court and represent you at trial.

You should contact our attorneys as soon as possible. Under Alabama law, you have just two years to file a personal injury lawsuit. The earlier you reach out to our car accident lawyers, the sooner we can start collecting evidence before it disappears and talking to witnesses before their memories fade.

Hit By an Uninsured Driver? Contact our Car Accident Huntsville Lawyers Today

If you or a loved one has been injured in a car wreck caused by an insured or underinsured driver, you may be entitled to benefits of which you may not even be aware. For a free consultation, please call our experienced Huntsville car accident attorney,s or complete our quick contact web form.

If you or a loved one has been injured in a car wreck caused by an insured or underinsured driver, you may be entitled to benefits of which you may not even be aware. For a free consultation, please call our experienced Huntsville car accident attorney,s or complete our quick contact web form.